Hello again my friends. Idaho state congressman have revisited our state laws as they apply to voting, and to be frank, I am not sure how much has changed. So, I wanted to make it readily available to all the state website detailing all you need to know about voting in Idaho. The picture below will serve as a link to the Idaho page on voter information. 🙂

Energy Efficiency Rebates in Latah County, Idaho

I just learned that Avista neatly put all in one place all the rebates that consumers can apply for in the state of Idaho that they will honor. Here’s a link to that information.

5 Ways You Can Use Smart Tech To Improve Your Home Life

Thanks to a guest blogger, Chelsea Lamb of Businesspop.net, for the following article. She saves me when I am busy serving my clients with buying and selling homes. 🙂

Photo via Pexels.

With home technology getting smarter every day, there has never been a better time to invest in these future-ready solutions. These technologies are becoming increasingly affordable, while the cost of hiring a local electrician to help you set them up is comparatively small. What’s more, the right smart home improvements may even help you get a better deal when it comes to selling your home in the future. These are the five areas where smart tech could make all the difference.

Entertainment

This is one of the most popular areas for people to start dabbling in smart technology. After all, the appeal of a smart entertainment system is hard to resist, from HD televisions connected to every possible streaming service to high-tech speakers and seamless projectors.

These smart devices are some of the coolest and most impressive around, but they do also tend to be quite expensive. Let’s be honest: there are probably more practical ways to spend your money. But if you can afford it, then go ahead and treat yourself to the best entertainment experiences money can buy. If you’re not there yet, start out with one of these smart devices under $50 to give you a taste of that smart home life.

Communication

A smart home hub like the Amazon Echo or Google Home can help every aspect of your home communicate with itself seamlessly, but it can also help you communicate better with the people that matter. You can leave messages for other members of the family, call loved ones, or even check in with someone in another room without leaving the couch.

But they’re not the only smart tech that brings people together. There has been a surge in devices that help people who are far away from each other feel closer, from couples in long-distance relationships to kids who miss their parents at camp. You can send each other tactile signals in real time, feel each other’s heartbeat, or simply reassure each other with a light pulse.

Security

Smart tech can also protect your family. Home security options such as the Ring doorbell or Blink outdoor cameras can help you keep an eye on your property and alert you to any danger. They even allow you to monitor what’s going on around your home when you’re away.

Green Living

Smart technology is one of the easiest ways to make your home more eco-friendly and can be an invaluable tool for green living. According to TechRadar, there are devices to reduce your electricity, water, heat, and gas consumption, as well as various appliances that are designed for efficiency. These options help you run a more environmentally-friendly home, but they can also save you a lot of money on bills in the long run, meaning they pay off in more ways than one.

Household Chores

If you are not one of those people who are lucky enough to enjoy chores, why not get some help? Technology can help you with just about any household task that you wish you could get out of. Hate vacuuming? Invest in a robot vacuum that does the work for you – this list by Wired includes options for every budget. Despise doing the laundry? Smart washers and dryers have WiFi capabilities to let you know when your load is done, automatic detergent-dispensing features, and can even detect how dirty your clothes are to select a cycle for you.

Despite what many doubters once thought, the internet of things isn’t going anywhere. As our world becomes more connected and technology expands what it can do, it is inevitable that our homes are going to become smarter. This societal change isn’t going to happen overnight, and neither is your home’s transformation into a futuristic smart pad. Start out slowly by investing in a smart home hub and a few smaller devices, and build your way up to the more expensive and experimental appliances. You’ll notice everyday tasks become easier and more efficient right away.

Buying a home in the Moscow area? Shannon May has you covered. Call 208-892-9256 today!

Reference Guide for getting set up post your move into a new home

As part of my process for my clients, I provide this kind of information for my clients but a guest writer wrote about it and thought- heck, people other than my clients may appreciate this too. So, without further adieu….

Finding Your Way Through Moscow, Idaho:

A Resource Guide for New Residents

Guest post by Patrick Young, ableusa.info

Are you new to the Moscow area? Curious to know how to get your utilities set up and find some local services to help get you settled in? If so, you’ve come to the right place! Below, are some important resources that will ease you into life in Moscow — including some attractions to visit once you’ve finished unpacking! Some of these resources are already under the About Moscow tab.

Get Your Utilities Set Up

Important Services for Parents

Top Daycare Centers

Find a Babysitter

Things to Do with Children in Moscow

Other Moscow Resources

AAA-Approved Auto Repair Facilities

Moving Your Business to Moscow

Things to Do in and Around Moscow

University of Idaho Arboretum & Botanical Garden

Appaloosa Museum and Heritage Center

Life in Moscow is wonderful — but you’ve got to get settled in first! With these resources, you’ll have your home in order in the blink of an eye. And once you’ve finished getting everything unpacked and squared away, you can start experiencing the sights and sounds that make Moscow such a family-oriented community and outdoor adventure seekers’ paradise or what Moscowvites just call home.

Thank you Patrick for your contribution to my blog. I don’t write on it as often as I should so a little help is always appreciated. And the readers, hope you find his all-in-one resources helpful when you are busy navigating the wilds of moving a household. 🙂 Shannon

City of Moscow’s Utility Newsletter Winter Tips

This is something I occasionally need to review with my clients, especially if they will not be living in their home during the winter months. Better safe than paying the plumber or the flooring guy to repair and replace items ruined as a result of frozen pipes having busted, right?

The recent water bill from the city included a section on Winter Weather tips which I am copying here for all to consider. I’d include a link but the city site is not up-to-date on archives of utility newsletters so the next best I can offer is the Water Department’s number which is noted in the text below. I did elect to bullet point the list for “eyeball” convenience so you can more readily comb through the suggestions for those new to you. Otherwise, it is verbatim, the same as in the newsletter.

Walter Baxter / Frozen solid / CC BY-SA 2.0

Without further adieu, what they shared:

Avoid Frozen Pipes

- Leave cabinet doors under sinks open, especially if they are located on exterior walls.

- Set thermostats no lower than 55 degrees, even if the house is unoccupied.

- Do not remove snow form the tops of water meter boxes unless it creates a safety hazard. An accumulation of snow will help insulate the water meter box and prevent freezing.

- Do not open water meter boxes as this will allow any natural heat to escape and may contribute to freezing of the water system.

- Insulation pillows (a small black pillow) are installed in most meter boxes. If your system tends to freeze, contact the Water Department. City crews regularly install insulation pillows in boxes that tend to freeze. If your pipes do freeze, the best way to defrost them is to use a hairdryer or call a plumber.

- For assistance with a system frozen at the meter box or help with other issues, call the Moscow Water Department at 208-882-3122.

Recycling those Plastic Bags

And a side note, since the plastic bag recycling option is still relatively new, I am adding here a reminder for myself and whoever else needs it because I don’t know about you but I keep forgetting which Saturday I can bring plastic bags for recycling. That one Saturday that they accept plastic bags is the first Saturday of each month.

And what kind of plastic you ask? Well, if marked, look for a #2 or #4; otherwise know that bubble wrap, air pillows, grocery bags, bread bags, ziploc and other reusable bags, case wrap, newspaper sleeves, produce bags, and dry cleaning bags all count.

Their Service Entitles Them To Low-Cost Loans. But Veterans Often Pay More

Happy Veteran’s Day my friends!!!

With this special day in mind, I thought I’d share an interview from NPR that I heard today on NPR regarding how Veterans have applied for loans and are sometimes charged more. It is brief yet has good information in it so I thought I’d share the link to the interview here. It also is a great message for everyone and why I like to encourage my Buyers to consider more than one lender as they often offer different loan vehicles and the costs and rates will usually vary a bit from one to another.

Leaving your house to your loved ones

A re-post of an article written by FIDELITY VIEWPOINTS – 09/14/2020. The original may be found at the link provided at the bottom of this post.

A good estate plan can save your family a lot of stress and money.

– Deciding what you’d like to do with a home is a decision that is financial, emotional, and logistical.

–Be sure to discuss your plans with your family to avoid discord and costly mistakes.

–There are many ways to transfer a house, including by will, revocable trust, transfer on death, and deed, among other options.

For many families, deciding what to do with a home can often be the most complex part of an estate plan: A house is potentially worth a significant amount of money, can be complicated to inherit, and may also be wrapped in memories and emotion. For these reasons, it is particularly important to come up with a specific strategy for the role a home plays in an estate plan.

3 things to know before getting started

1. Input from everyone involved can make planning easier

To prepare for a smooth and efficient transfer of a home, start by thinking about your goals and your financial situation. First ask: What would you like to see happen with the house? After understanding your goals, be sure to discuss your wishes with your family.

Your children may have different ideas about whether they would want to live in, sell, or keep the property for investment purposes. It can be difficult to have these conversations, and you may want to have someone neutral help facilitate the conversation, but it is very important.

For example, consider a couple who was planning to leave a vacation home to their 2 children equally so that the children could continue the long tradition of family vacations. However, one child lived far away and already owned a vacation home in that area. Leaving the home equally would have created issues regarding maintenance cost, property taxes, and upkeep. If the siblings decided not to share the house and executed a transfer of ownership, it might have increased taxes and created transaction costs. Disagreement on whether to continue shared ownership could also have caused hurt feelings and disrupted what was otherwise a good relationship. A family conversation helped them realize that a shared inheritance didn’t make sense.

2. Your heirs could end up owing money

If the person who inherits the home doesn’t want to keep ownership of it, they may incur legal fees, taxes, and other transaction costs. In addition, several states have estate tax exemption limits far below the federal level. If the value of the home exceeds that limit and there aren’t other assets from the estate available to pay the taxes, the heir may face a state estate tax bill and may have insufficient funds to pay it. That could force a sale of the home or force the heir to seek financing options to pay the bill. If they do sell the house, it will be taxed based on the value at the time of the original owner’s death.

3. The mortgage might become due

Most mortgages have a “due on sale” clause that may be triggered at death. If so, other liquid assets in the estate would need to be used to pay off the debt, the inheritor would need to qualify for a mortgage on their own, or the home would need to be sold.

6 options for passing down your home

Let’s look at a number of different ways to make passing down a home as smooth as possible.

1. Co-ownership

One common idea that people have about passing the home to kids is seemingly simple: Just add the heirs as co-owners on the current deed. If the deed lists someone else as a joint tenant, they will become co-owners at the time the deed is changed, and they will automatically take ownership of the home at the time of the original owner’s death.

There are some downsides to this approach, however. First of all, if a child is added as a co-owner, there are gift tax considerations. There is a limit to how much someone can gift another person without paying a gift tax, both yearly and in a lifetime. When a house is given as a gift through co-ownership, the portion transferred is considered a taxable gift and counts toward the lifetime exemption, so it has to be reported for gift tax purposes. Say a single parent adds a child to the deed, the parent would need to report 50% of the value of the home as a taxable gift (based on the fair market value of the home at the time of the transfer).

Secondly, gifts made during a lifetime are subject to carryover cost basis (the value of the house for tax purposes). Thus, the cost basis used for capital gains tax purposes doesn’t get a step-up at the time of death—instead, the child may get a larger tax bill on the portion of the house that was given to them if they eventually sell the house after the co-owner’s death.

Finally, as co-owners, the home becomes an asset of the child, creating several potential issues. First, if the child runs into financial trouble, gets divorced, or has other issues, your home may be put under a lien or become subject to other action. Second, the co-owner would need the child’s permission to sell the home, take out a new mortgage, or refinance an existing one. And finally, the child may decide they would like to sell the home, which can create challenges.

2. A will

A will can be used to pass on a home. This process helps ensure that the owner decides who inherits the property. However, assets that transfer through a will still pass through the probate process, which can be time-consuming and expensive. In addition, a will is a public document, so anyone can review the decedent’s assets and see who inherited them, so this can create a privacy concern.

3. A revocable trust

A revocable trust is a legal structure that allows the “grantor” or “trustee” to retain control over their assets during their lifetime, as well as specify exactly how and when their assets pass to their beneficiaries. After the trustee’s death, the trust acts as a will substitute and enables the assets to be privately and quickly distributed without going through the time and expense of the probate process. This will allow the trustee full control and use of their home during their lifetime while providing for efficient distribution at their death.

Due to the complexity of trusts and the variation in state-level rules, it is important to work with a professional to set up a trust, which costs money, but may be the only way to help ensure that the trust works effectively. It is also important to remember that it may be necessary to change the titling of your assets for the trust to function as intended.

Finally, a trust may be particularly beneficial for families that own properties in more than one state. Without a trust, an estate may pass through probate in multiple states. “For many of my clients, one of their main goals is to pass down assets to beneficiaries without probate, and so a revocable trust is a core component of their estate plans,” says Terri Lyders, Vice President, Advanced Planning at Fidelity.

4. A qualified personal residence trust (QPRT)

A QPRT is a way to move a primary or vacation residence out of your estate at a reduced gift tax cost. With a QPRT, the home is transferred to the trust right away, but it allows the original owner to retain the right to live in the home for the duration of the QPRT term. During that time, they are responsible for rent, maintenance, taxes, and other aspects of ownership. The trust has an end date after which ownership of the house is transferred to the beneficiary (generally children or a trust for their benefit) and the original owner no longer has the right to occupy the house (although a lease may be negotiated with the beneficiary).

In order for this strategy to be effective for tax purposes, the original owner must outlive the term of the trust. Otherwise, if they die before the trust terminates, the value of the home is included as part of their taxable estate and could be pulled back into the estate. While a QPRT may be used for a primary residence, it can be challenging for a person to lose the right to occupy their home, or pay rent to do so, and thus QPRTs may often be used for vacation homes.

Two big benefits of a QPRT include the reduced gift tax cost of the transfer (because the owner retains the right to live in the home for a period of time and keeps some of the value of the house), and that the value of the home is frozen for estate tax purposes at the time the trust is created. This means that for estate tax purposes, the value of the home is established at the time it enters the trust—and future price appreciation won’t affect the estate’s tax bill. For a family facing estate tax issues, this strategy may help to limit taxes in the event that the property value increases over time.

Tip: A property that is subject to a mortgage can be difficult to handle from a gift tax perspective, and therefore it is often suggested that any debt be paid off prior to the transfer to a QPRT.

5. A beneficiary designation—a transfer on death (TOD) deed

Some states offer a TOD designation on a deed which essentially names a beneficiary for that property. With a TOD designation, assets pass outside probate, so it’s quick and private, and the heirs still get a step-up in basis for tax purposes, which means the value of the house is adjusted to current market value. It may also be less expensive than setting up a trust.

There are some drawbacks to a TOD designation. It only allows individuals or charities as beneficiaries, not a trustee under a trust. That means that if a child is still young at the time of the transfer, they would directly own the home, which may not be practical. There is also no contingency, so if the child named as beneficiary dies before the original owner, there is no provision to skip a generation and pass the asset to their children—the TOD deed would have to be updated by the owner. Additionally, if the home is passed to an adult receiving government benefits, it could affect their eligibility.

Tip: TOD deed options are limited by state law, and many states do not offer this option at all. Check with your attorney or tax advisor to determine whether this option is available and would be appropriate for your circumstances.

6. Through selling

If it’s unlikely that children will want the home, consider selling it and renting a home later in life. Issues like maintenance, health, and lifestyle may be more important than the financial considerations here, but be sure to consider the tax impact of this decision.

Current federal tax law allows a capital gains exclusion of either $250,000 (for an individual) or $500,000 (for a married couple filing jointly) on the sale of a house, provided that they have lived in that house for 2 of the previous 5 years, and that the home meets the residency requirements. Gains above that amount are taxed. Inheriting a property comes with a step-up in basis (which means it’s reassessed at current market value) potentially eliminating capital gains tax.

The bottom line

A home can be the most valuable asset in an estate. If you don’t take any action and die without a will or having made any other arrangements, your assets will pass according to your state intestacy laws, which may or may not reflect your wishes. This may include going through probate—a process that is potentially expensive, public, slow, and complicated.

The transfer of real estate assets can pose unique legal, tax, and emotional issues for a family, so it may be beneficial to work with a professional to help protect yourself and your loved ones. It’s important to come up with a plan that makes sense for you, and your heirs, and to create an efficient strategy to execute it.

Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation.Votes are submitted voluntarily by individuals and reflect their own opinion of the article’s helpfulness. A percentage value for helpfulness will display once a sufficient number of votes have been submitted.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Full disclosure from your blogger in charge: I have an account with Fidelity and favor the features and tools Fidelity provides their clients and the public at large for free. To view this article from the original source, please visit:

https://www.fidelity.com/insights/personal-finance/house-estate-plan?ah=1

4 Steps That Can Help Seniors and Homebuyers with Disabilities Save Time and Stress

Today I am posting another writer’s article who reached out to me to share useful tips to helping Buyers navigate the real estate market and some of these tips are handy for anyone in the market for a property.

Watching people hunt for the perfect home on TV can be entertaining. When it comes to hunting for your perfect home, however, things can feel more stressful than exciting. This can be especially true if you’re a homebuyer who is also living with disabilities, as you will likely need to find a home that has accessibility features. That can be overwhelming for many shoppers. So, if you’re worried about the process of finding and buying that accessible home, keeping these tips handy can give you some serious peace of mind.

Finances Should Come First

When it comes to being smart about buying an accessible new home, you really need to start with some financial steps. Gather any pertinent documents related to your finances — including tax returns, bank statements, and credit reports — and go over them very carefully. That way, you can put together a realistic price point for your new home.

Wondering what that price will get you in your desired location? You can use online tools to research local home prices and features included in local listings. Couple that information with the right financial steps and you should be in good shape to start searching for a new home with the accessibility elements you need and the features you want.

Something to consider here as well is that it’s always best to have a knowledgeable lender by your side before you start your official house hunt. Look for a lender associated with the Idaho Housing and Financial Association. Tim Kinkeade with First Home Bank is an excellent example of a loan originator with decades of experience. Your loan officer can even help you find state-funded programs that can help with down payment money if you’re struggling to come up with the cash you need to make the leap into homeownership.

Using All the Tools at Your Disposal

If you are serious about buying an accessible home, you should work with a realtor right after you have your financial plan sorted out. Local real estate agents will likely have access to more listings that are available online; plus, you won’t have to comb through multiple sites. You may even be able to find an agent with special certifications that can make the process even smoother, especially if you are a senior with disabilities looking for a new home with more accessibility. Either way, be sure to let your realtor know which features are crucial for you.

Of course, these are difficult times for house hunting since most of the country is on COVID-19 lockdown. The good news is that you can use online tools to get a clearer picture of the local market and specific homes you’re interested in. For example, some agents offer live virtual tours of homes which will give you an in-person perspective. While it’s not the same as being there in person, you’ll still be able to explore the house without having to leave home.

Accessibility Can Be Stylish

If this is your first time looking for a home with accessibility features, you should know that accessibility does not have to be boring when it comes to home design. Just check out this home that was created for a buyer who became disabled after a motorcycle accident. After a complete renovation, an older ranch-style home was transformed into a completely wheelchair-accessible living space, with small touches that make getting around and getting comfortable easier. Safe bathrooms can be beautiful as well, especially with the growing popularity of walk-in showers. The newest showers are just as stylish as they are safe, and they can be added to your home for around $1,000 to $2,300, depending on the size you need.

Modifications May Be Needed

As you can see from the accessible home example above, renovations may be necessary in order to turn your dream home into an accessible safe haven. That shouldn’t put you off from your home search, but you will need to budget for modifications as you determine how much home you can afford to buy. You can also look into additional financing options that can help cover any needed home modifications, including special FHA home loans. These loans do come with additional stipulations but you can use them to make just about any type of improvement to your new home. For accessibility modifications, you may also be able to use other funding sources to help out with costs, including grants from non-profits or VA benefits. Your lender might be able to offer suggestions here as well.

Buying a home that includes accessibility features shouldn’t be any more stressful than finding a home that doesn’t. Still, homebuyers who are living with a disability can face additional challenges when searching for their dream home, including having to budget for future home modifications and finding a home where they can age in place safely during their golden years. If you are a home shopper who is living with disabilities or looking to age in place in your next home, be sure to keep this guide handy so you can save yourself some hassle.

Patrick Young is an educator and activist. He believes people with disabilities must live within a unique set of circumstances–the outside world often either underestimates them or ignores their needs altogether.

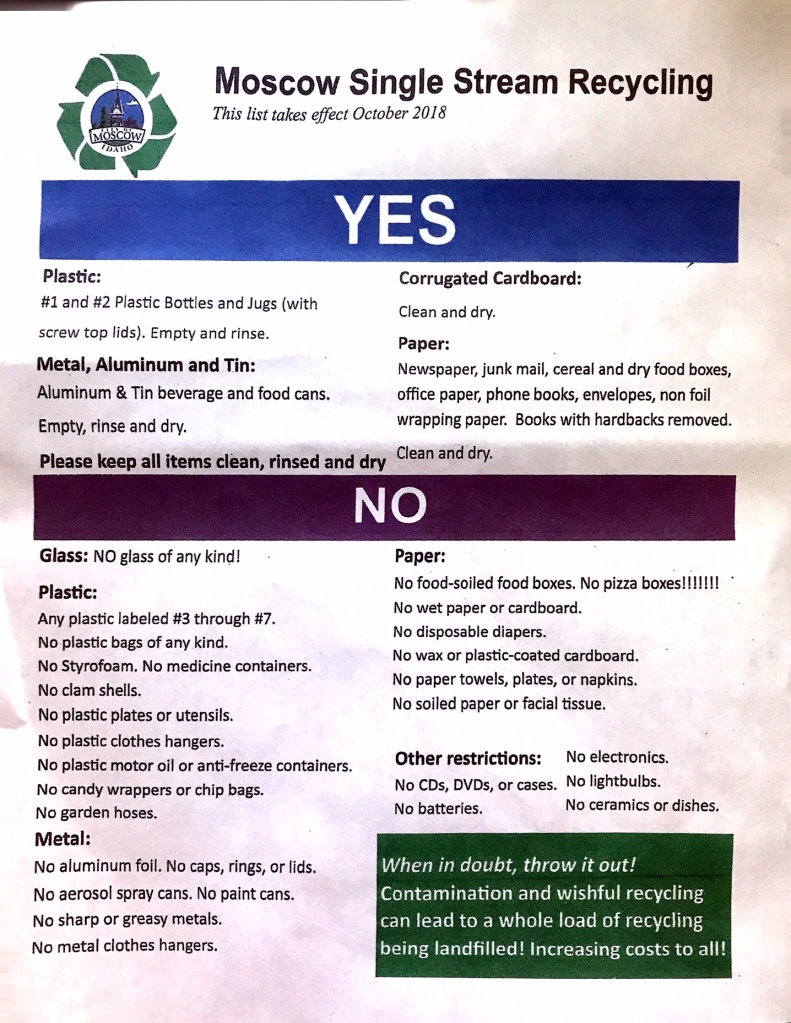

City of Moscow Recycling Guidelines 2.0

The rules of the road have been changed, or by some understandings, uncovered, as to how recycling must be done. If the guidelines are not followed, tons of recyclables mixed iwth non-reclycable items get dumped in landfills which has led to our city revamping our own rules to help us avoid this problem.

Good as these intentions may be, we humans tend to not like change and need a little aid ourselves in keeping straight what can and cannot go into those recycle bins. Below is a picture I took of the single stream (read curbside green bin pick up) of what is acceptable and what is not.

Below is what I took regarding those pesty plastic bags and any other plastic packaging film. Our recycle center has a contract with the Trex Deck company to recycle all those plastics and you can learn when and where to depot those bags below….

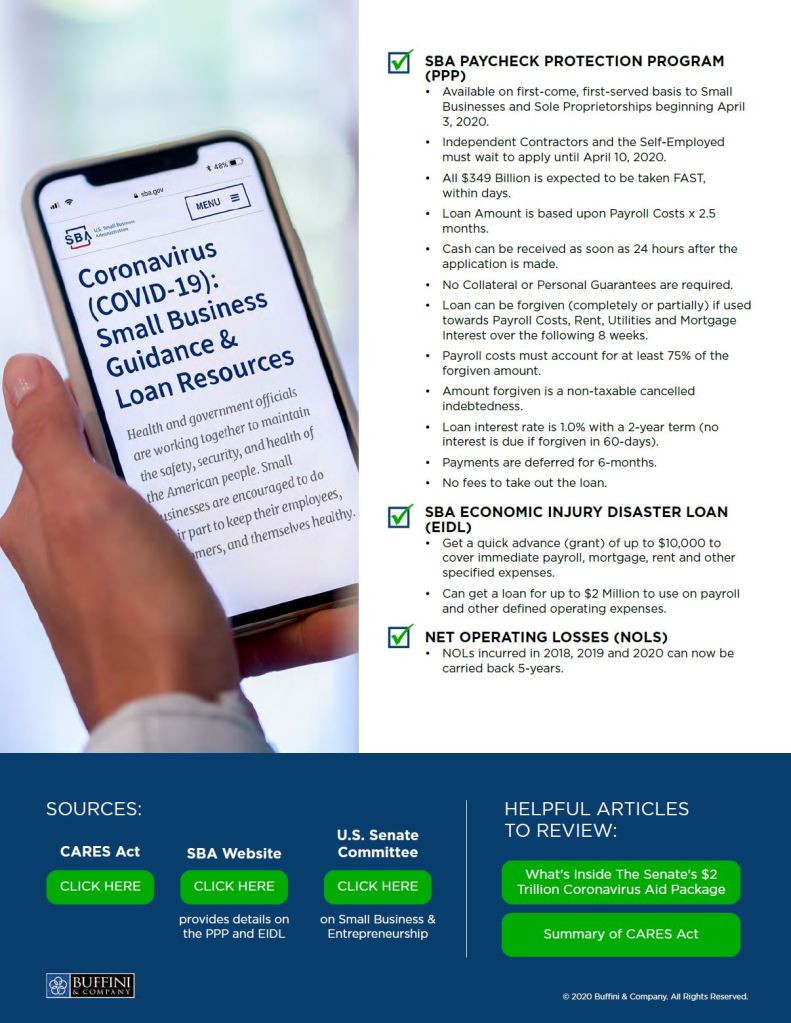

What does the Cares Act do for you?

Congress passed the CARES Act recently and many wonder if there is anything in the program that may help them in this time of need. Some may think no but may be wrong as the Act was designed to provide aid to as many as possible, covering more people in a variety of ways. Below is a brief overview of what the program offers Americans so you can see how it may help you or your family and friends….

CARES Act SBA Website U.S. Senate Committee

What’s inside the $2 Trillion Coronavirus Aid Package

Summary of CARES Act